Why are transfer fees high in France? And in other countries? Concrete examples

Transfer fees in France, also called notary fees, can seem high due to the combination of several taxes and costs associated with real estate acquisition. The main components of notary fees include the land registration tax, the additional tax, notary fees, disbursements, and other miscellaneous costs.

- Property Advertising Tax and Additional Tax: These taxes represent a significant portion of notary fees. The land registration tax is proportional to the sale price of the property, and it varies depending on whether it is an old or new property. The additional tax is added to the land registration tax.

- Notary's Fees: Notaries receive fees which are regulated by the State. These fees pay for the services of the notary.

- Disbursements and Miscellaneous Costs: Disbursements include costs advanced by the notary on behalf of the buyer, such as costs related to administrative procedures and formalities.

In other countries, the fee structure associated with real estate transactions may differ. For example, closing costs in the United States typically include title, insurance, and recording fees, but they are not as regulated as in France.

France :

- Sale price: €300,000

- Notary fees (estimate): Around 7 to 8%, or €21,000 to €24,000

UNITED STATES :

- Sale price: $300,000

- Closing costs (estimate): About 2-5%, or $6,000-15,000

Germany :

- Property transfer tax (Grunderwerbsteuer): Varies between federal states (3.5% to 6.5%)

- Example: €300,000 property in Bavaria, costs around €15,000.

United Kingdom :

- Stamp Duty Land Tax: Varies depending on price brackets

- Example: House £400,000, tax around £10,000.

Canada:

- Transfer taxes: Vary by province

- Example: Property of 500,000 CAD in Ontario, tax of approximately 12,950 CAD.

Australia:

- Property transfer tax (stamp duty): Imposed by states

- Example: AUD 600,000 house in New South Wales, tax approximately AUD 22,490.

Japan:

- Transfer tax: Relatively low, often less than 1%

- Example: Property of 100,000,000 JPY, transfer fee of approximately 1,000,000 JPY.

Singapore:

- Document Fees (Buyer's Stamp Duty): Imposed for real estate transactions

- Example: Property of SGD 800,000, rights of approximately SGD 24,600.

The examples above highlight the diversity of transfer costs around the world. Differences are influenced by tax policies, local regulations, and real estate market practices specific to each country. Understanding these variations is crucial for international buyers to make informed decisions when purchasing real estate abroad. Remember to consult a local professional for advice specific to your situation.

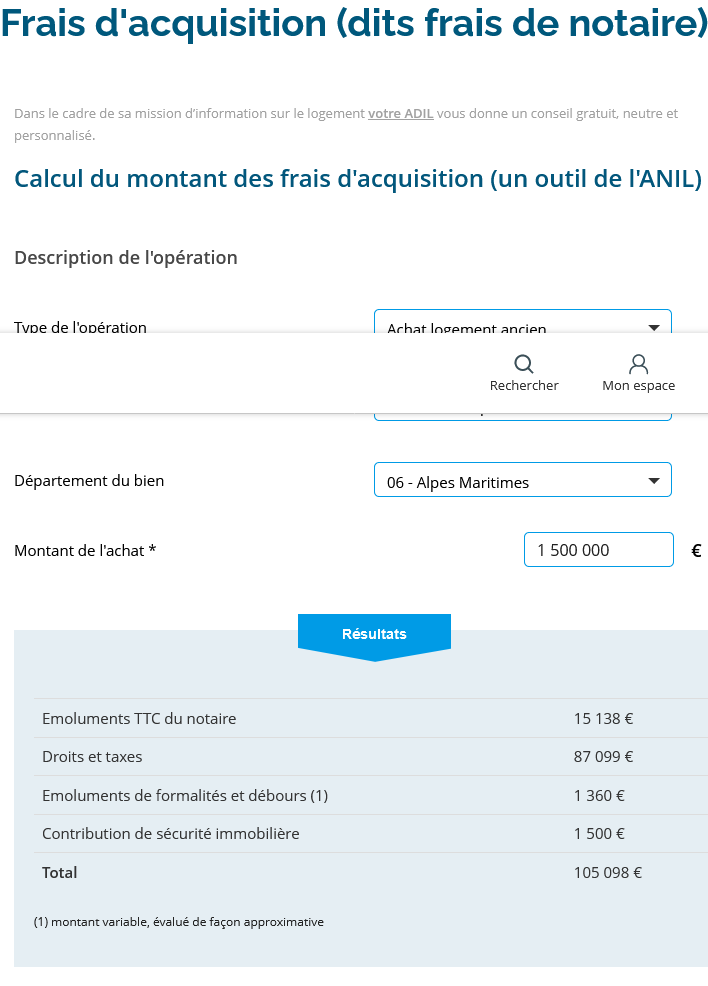

Example Sale of an old apartment in department 06 for €1,500,000

Transfer duties, notary fees: definition, calculation

Join the adventure by registering on the Properties de Charme social networks!

Don't miss any news, discover real estate gems and immerse yourself in the world of luxury. Join us on Facebook, Instagram, Twitter, and more. Opulence awaits with every click!

Facebook Twitter LinkedIn Instagram Pinterest

Finding the luxury property of your dreams is now easier than ever!

🌟 Use our advanced search engine to find your ideal luxury property . Refine your selection with sophisticated filters and view on a map. Real estate perfection just a click away!

What are you looking for ?

Explore our catalog of luxury properties for sale in France, sorted by department . Easily discover a refined selection of premium real estate, conveniently curated to suit your preferences.

Browse our catalog of international luxury properties, carefully categorized by country . Effortlessly explore a variety of exclusive real estate around the world, organized to simplify your search according to your favorite destinations.

Would you like to get an estimate for your high-end property?

free, no-obligation valuation of your prestigious property now .

Luxury real estate professionals

🌟 Post your prestigious ads now ! Contact our customer service for more information. Consult the criteria for publishing advertisements and discover our system for ranking your properties .