Everything you need to know about transfer fees, commonly known as Notary Fees

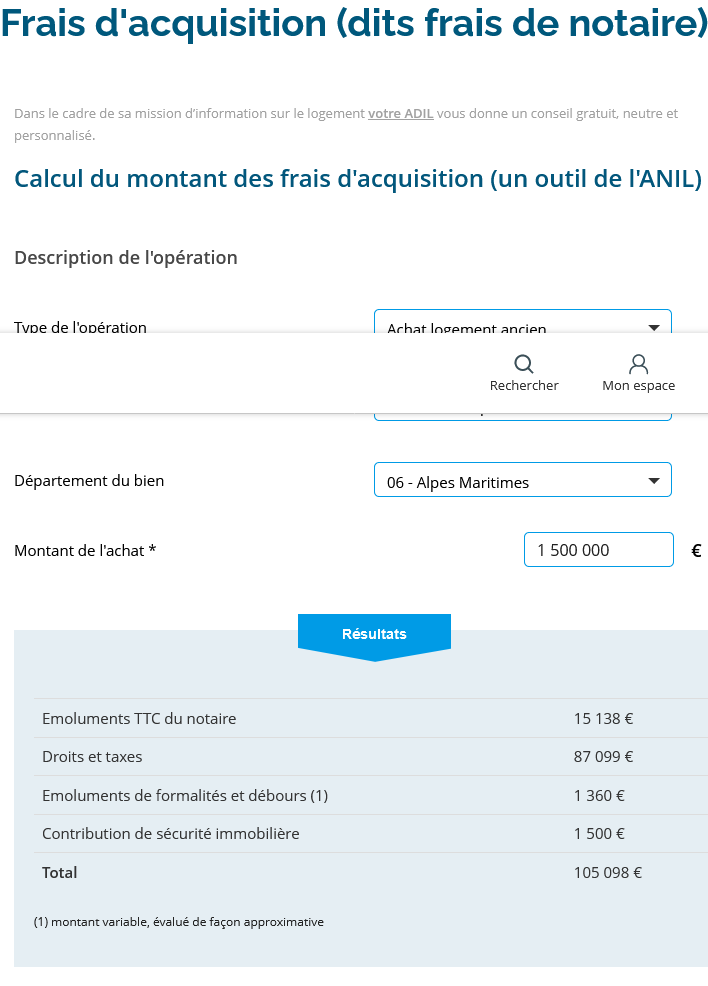

Explore the world of transfer fees, often called notary fees, and find out how to calculate them accurately. Use our link to the ANIL calculation tool to estimate your transfer costs based on your particular situation .

Please note: In old properties, transfer taxes are generally 7 to 8%, while in new properties with reduced notary fees, they are between 2 and 3%.

Transfer taxes

Also known as registration fees, are taxes levied by the state upon the transfer of real estate. Real estate transfer occurs when there is a change in ownership of a property, generally as part of a sale.

Transfer taxes vary by country and region, and sometimes even locally. These rights are calculated as a percentage of the sale price of the property or its market value, and they are paid by the buyer. In general, the higher the value of the property, the higher the transfer taxes.

In France, for example, transfer taxes are often referred to as notary fees, although this is technically incorrect. These rights include the land registration tax and the additional land registration tax. The rate of these duties varies depending on the nature of the property (new or old) and the geographical location.

It is important to note that transfer taxes only cover part of the total notary fees. Notary fees also include notary fees, disbursements, and other taxes and miscellaneous fees related to the real estate transaction. To estimate the transfer rights specific to your situation, you can use the calculation tool of the National Agency for Housing Information (ANIL) or consult a notary.

In France, transfer taxes vary depending on the nature of the property (old or new) and the geographical location. Transfer taxes are generally made up of the land registration tax and the additional tax to the land registration tax.

- In the old one:

- The land registration tax is generally 5.80% of the sale price of the property.

- The additional tax to the land registration tax is 0.70%, bringing the total rate to 6.50%.

- In the new:

- The land registration tax is 0.715% of the sale price.

- The additional tax to the land registration tax is 0.10%, bringing the total rate to 0.825%.

It is important to note that these rates may vary depending on the specifics of the transaction, the geographic location, and any applicable exemptions or reductions. These figures are based on rates in effect as of my last knowledge update in January 2022.

Therefore, to obtain an accurate estimate of the transfer rights for a specific property, it is recommended to consult a notary or use online tools such as those provided by the National Agency for Housing Information (ANIL) for France, which can take into account the specificities of your transaction and your location.

Notary fees

Notary fees are costs linked to the sale of real estate. They are usually paid by the buyer and include various fees and taxes.

Composition of notary fees:

- Transfer duties: These duties are taxes collected by the State during the transfer of real estate. Their rate varies depending on the region and the type of property.

- Notary fees themselves: These fees pay the notary for his services. They include fees (notary's remuneration), disbursements (costs advanced by the notary on behalf of the buyer), and miscellaneous costs linked to the formalization of the transaction.

- Miscellaneous Taxes: There may be other local taxes to pay depending on the region.

Example Sale of an old apartment in department 06 for €1,500,000

Why are notary fees and costs high in France?

Join the adventure by registering on the Properties de Charme social networks!

Don't miss any news, discover real estate gems and immerse yourself in the world of luxury. Join us on Facebook, Instagram, Twitter, and more. Opulence awaits with every click!

Facebook Twitter LinkedIn Instagram Pinterest

Finding the luxury property of your dreams is now easier than ever!

🌟 Use our advanced search engine to find your ideal luxury property . Refine your selection with sophisticated filters and view on a map. Real estate perfection just a click away!

What are you looking for ?

Explore our catalog of luxury properties for sale in France, sorted by department . Easily discover a refined selection of premium real estate, conveniently curated to suit your preferences.

Browse our catalog of international luxury properties, carefully categorized by country . Effortlessly explore a variety of exclusive real estate around the world, organized to simplify your search according to your favorite destinations.

Would you like to get an estimate for your high-end property?

free, no-obligation valuation of your prestigious property now .

Luxury real estate professionals

🌟 Post your prestigious ads now ! Contact our customer service for more information. Consult the criteria for publishing advertisements and discover our system for ranking your properties .