Luxury real estate in Rouen: villas, apartments and prestige properties

Discover the luxury market in Rouen: popular neighborhoods, types of properties, prices and advice for buying a villa,

The sales agreement is a key step in any real estate transaction. It legally binds the seller and buyer, formalizing their shared desire to complete the sale under certain conditions. Drafting a comprehensive and rigorous sales agreement is essential to ensure a secure transaction, avoid disputes, and streamline the process until the final signing at the notary's office.

At the heart of this drafting, the quality and completeness of the file provided to the notary play a decisive role. Indeed, the notary will only be able to move forward with the preparation of the deed if all the necessary documents are in his possession. Among the fundamental elements are the suspensive conditions, particularly those related to the buyer obtaining a mortgage, which often determine the validity of the sale.

This article provides a comprehensive overview of the documents required to draft an effective sales agreement, while emphasizing the specificities and challenges of suspensive clauses relating to financing.

The sales agreement, often called a "synallagmatic promise of sale," is a preliminary contract that binds both parties: the seller agrees to sell, and the buyer agrees to purchase, the property. This document must contain a certain number of mandatory details and specifies the conditions of the sale, such as the price, the description of the property, and any conditions precedent.

The compromise should not be confused with the unilateral promise of sale. In the latter, only the seller is committed to selling to the beneficiary, who retains the freedom to buy or not. The compromise is binding on both parties. This reinforces its importance in securing the transaction.

Although the preliminary agreement may be drafted by a real estate agent or lawyer, the notary remains a key player. They ensure legal compliance, verify the property's legal status, collect the necessary documents, and ensure the legal security of the sale. An incomplete file slows down their work and can delay the signing.

Once signed, the agreement is binding on the parties. The seller cannot withdraw without compensating the buyer, and the buyer is also required to lift the conditions precedent or cancel the sale. In the event of non-compliance, penalties may be applied.

For the notary to draft a reliable, clear, and legally secure sales agreement, they must have a complete and organized file. This file includes several categories of essential documents, which concern the parties to the sale, the property, and the legal and administrative environment surrounding the transaction.

Identity documents of the parties : Valid identity card, passport or residence permit, to clearly identify the seller and the buyer.

Proof of legal capacity : For example, if one of the parties is a company, a recent Kbis extract, the statutes, and the resolution authorizing the sale or purchase.

Power of attorney : If one of the parties acts by proxy (agent), the written and signed mandate must be attached.

Title deed : Document certifying the seller's ownership, often issued by the notary who made the previous acquisition.

Cadastral plan : Allows you to precisely locate the property and demarcate its plots.

Mandatory technical diagnostics :

Energy performance diagnosis (DPE)

Asbestos

Lead

Termites

State of natural, mining and technological risks (ERNMT)

Gas

Electricity

Non-collective sanitation, etc.

Co-ownership regulations and minutes of general meeting : If the property is in co-ownership, these documents specify the rules, charges and any work voted on.

Latest charge receipts : To inform the buyer of current expenses.

Certificate of administrative situation : Allows you to check the absence of ongoing procedures (expropriation, pre-emption).

Town planning certificate : Provides information on the town planning rules applicable to the land or property.

Surface area certificate (Carrez Law) : Mandatory for co-owned lots, it certifies the private surface area.

Property tax and housing tax : Tax notices allow you to calculate tax charges.

Mortgage Status : Certificate issued by the mortgage office indicating whether there are any mortgages or other liens encumbering the property.

Easements : Documents specifying any easements (passage, pipeline, view, etc.).

Rental situation : Current lease, rent receipts, inventory if the property is rented.

Certificate of non-pledge : If a vehicle is linked to the sale (rare but possible in certain atypical real estate sales).

Recent or planned work : Estimates, work permits, building permits or prior declaration if modifications have taken place.

Claims history : Insurance declarations, appraisals, repairs carried out.

Sanitation diagnosis : In the case of individual sanitation, certificate of conformity.

Documents relating to co-owners : List of co-owners, contact details of the trustee.

When a buyer needs bank financing to purchase real estate, including a loan condition precedent in the sales agreement is an essential step in securing the transaction.

The loan condition precedent is a clause in the sales agreement that specifies that the sale will only be completed if the buyer obtains a bank loan that meets certain criteria. This clause protects the buyer: if the loan is refused, they can cancel the sale without penalty and recover their security deposit.

In general, the duration is set at 30 to 60 days after signing the compromise.

This period corresponds to the period during which the buyer must submit their loan application and wait for the bank's response.

It is possible to request an extension, but it must be accepted by the seller.

The compromise must indicate the amount of the loan requested : generally, a percentage of the sale price (example: 80% of the price).

The maximum acceptable interest rate must also be specified: for example, a fixed rate not exceeding 3.5%.

These parameters make it possible to precisely define the financial conditions acceptable to the purchaser.

The buyer must be diligent in their search for a loan.

He must submit at least one or more loan applications to banking establishments within the given time limit.

It is advisable to keep all documents proving the steps taken (letters, emails, refusals, proposals).

If he does not take these steps, he could be considered to have waived the suspensive condition.

A security deposit is generally paid when signing the agreement: often 5 to 10% of the price.

This amount is held in escrow with the notary or real estate agency.

If the suspensive condition is not met (loan refused), this deposit is returned to the purchaser.

If the suspensive condition is lifted (loan granted), this deposit is deducted from the sale price.

If the buyer does not meet their loan search obligations or does not provide proof of refusal, the seller may request the lifting of the condition and possibly withhold the security deposit.

If the loan is accepted, the condition is lifted and the sale can be finalized.

This suspensive condition is a key point in securing the transaction, both for the buyer and the seller. It must be drafted precisely to avoid disputes.

In addition to the mortgage condition precedent, several other clauses can be included in a sales agreement to protect the parties, particularly the buyer. These conditions are essential to secure the transaction against unforeseen legal, administrative, or technical issues.

Building permit, prior declaration, or other authorizations : when the purchase concerns building land, a construction project, or a major modification, the completion of the operation often depends on obtaining administrative authorizations.

The compromise may provide that the sale is subject to obtaining these authorizations within a fixed period.

In the event of refusal, the purchaser may withdraw without losing their security deposit.

In certain cases, the local authority (town hall, department) may exercise a right of pre-emption on the property sold.

The sale is then suspended for the legal duration of exercising this right (generally 2 months).

The suspensive condition specifies that the sale will only be final if the community does not exercise this right of pre-emption.

If the pre-emption is exercised, the seller must sell to the community and the sale is cancelled for the purchaser.

Certain mandatory diagnoses (asbestos, lead, termites, etc.) may reveal significant anomalies.

The compromise may include a suspensive condition linked to the completion of these diagnoses and the possibility for the purchaser to withdraw if major risks are detected.

The purchaser may include a suspensive condition linked to the property's compliance with current standards (urban planning, accessibility, security, etc.).

If serious irregularities are found, the sale may be cancelled.

Sometimes the buyer needs additional financing (bridging loan, personal loan, etc.).

The compromise may provide that the sale depends on obtaining this additional financing.

Each condition must be clearly written, setting specific deadlines and objective criteria. This avoids conflicts and disputes between the parties.

A sales agreement can only be properly drafted by the notary if he has a complete file, containing all the documents necessary to verify the legal, administrative, technical, and financial situation of the property. The absence of essential documents leads to significant delays and can jeopardize the signing of the agreement.

Valid identity documents : national identity cards, passports, or residence permits for foreigners.

Articles of association and Kbis extract (for sellers or buyers who are legal entities).

Representation mandates if applicable (agent, power of attorney).

Title deed : authentic deed of acquisition or certificate of ownership.

Latest property tax and housing tax notice.

Cadastral plan to precisely locate the property.

Co-ownership regulations and financial statements (for a co-owned lot).

Urban planning documents :

Recent town planning certificate (simple and operational).

Building permit, prior declaration, or certificates of conformity, if recent work or construction project.

Mandatory technical diagnostics :

Energy performance diagnosis (DPE).

Asbestos, lead, termites, gas, electricity, natural and technological risks (ERNMT).

Carrez Law surface area for co-owned lots.

certificates and attestations (compliance of installations, building permit cleared of any appeal).

mortgage status certificate (to check any charges or mortgages).

Certificate of non-pledge (for goods with the right to non-pledge, such as certain land).

Statement of current loan status (in the event of current credit on the property to be sold).

Estimate or bank loan offer (for the buyer).

Bank loan offer or conditional certificate.

Administrative files relating to planning permission.

Documents proving the absence of pre-emption rights or the absence of opposition.

Division deed (for land or co-ownerships).

Certificate of completion of work.

Documents relating to possible easements.

Insurance certificates for certain specific cases.

In order for the notary to draw up a compromise quickly and without errors, the file must be carefully prepared in advance, with up-to-date, complete and clear documents.

The agent must:

List the necessary documents precisely ;

Anticipate the notary's requests ;

Contact the administrations, technical services, or previous owners if necessary ;

Clearly classify and name each transmitted file.

Preparing a complete and thorough file is the key to a smooth transaction. The notary will be able to ensure the swift and secure drafting of the preliminary agreement, limiting the risk of errors or misunderstandings that could delay the sale.

Drafting the sales agreement is a crucial step that legally binds both sellers and buyers. It must be carried out with rigor and clarity to avoid any subsequent disputes.

The sales agreement is a preliminary contract which sets out the conditions of the sale and firmly binds the parties, subject to the suspensive conditions.

Once signed, the compromise can be enforced (obligation to buy and sell), unless a suspensive condition is not lifted.

It also serves as a basis for obtaining financing from banks.

Full identity of the parties : sellers and buyers, with their contact details.

Precise description of the property : address, surface area, nature, cadastral references.

Sale price and payment terms (deposit, balance, costs payable by the parties).

Conditions precedent :

Obtaining the loan by the buyer (with deadline, maximum rate, amount, duration, etc.).

Obtaining the necessary administrative authorizations.

No right of pre-emption.

Time limit :

Validity period of the compromise.

Deadline for lifting the suspensive conditions.

Deadline for signing the final act.

Amount of the security deposit (often 5 to 10% of the price) to be paid upon signing the agreement.

Clauses relating to late payment penalties or compensation in the event of non-completion of the sale.

Obligations of the parties (access to the property, maintenance, condition of the property, etc.).

Mention of the possible use of mediation in the event of a dispute.

Accuracy of information : any error may result in the invalidity of the compromise or disputes.

Clarity of suspensive conditions : define the criteria and deadlines precisely to avoid any ambiguity.

Diagnostic control : ensure that they are valid and compliant.

Mention of easements, charges, mortgages : crucial information for the buyer.

Inclusion of annexes : technical documents, regulations, plans, diagnostics, certificates.

Signature of the parties : essential, in original or by secure electronic means.

Receipt of a copy signed by each party.

The notary ensures the legal conformity of the compromise and legal security.

The agent or real estate agent assists the parties in collecting documents, understanding clauses and signing.

The buyer and the seller must be clearly informed of their rights and obligations .

A rigorous and comprehensive drafting of the compromise is the key to a successful transaction, without unnecessary risks or surprises. It provides legal security for the parties' commitment and allows for a calm preparation for the signing of the final deed.

A suspensive condition is a clause in the sales agreement that suspends the final execution of the contract until a specific event has occurred. If this condition is not met within the specified time limit, the agreement becomes void and the parties are released from their obligations, without penalty.

Among all the suspensive conditions, the most frequent is that linked to obtaining bank financing.

It protects the buyer, who does not want to be tied down if he or she cannot finance the purchase.

It also provides security for the seller, because the compromise only becomes a final sale if the buyer has the funds.

The time limit for obtaining the loan is strictly regulated, often around 30 to 60 days.

Without this clause, the buyer could be forced to buy even without financing, which is very risky.

To be valid and reassuring, the clause must specify several points:

Length of time : the time given to the buyer to obtain a response from the bank, generally 30 to 60 days from the signing of the compromise.

Maximum loan amount : must correspond to the amount needed to finance the purchase, with a margin if necessary.

Maximum accepted interest rate : often set to prevent the buyer from being tied into an overly expensive loan.

Maximum loan duration : sometimes specified to avoid financing offers that are too far apart.

Obligation to actively seek financing : the buyer must provide proof of having taken serious and multiple steps (e.g.: provide proof of loan applications).

Declaration on honor : certifying that the buyer has done everything possible to obtain a loan.

Make loan applications quickly : in order to meet deadlines and avoid the condition being void.

Ensure that the loan application covers the amount indicated in the compromise.

Follow the bank instruction closely, provide all requested supporting documents.

Inform the seller or notary in the event of difficulty or refusal.

Make sure you have several loan proposals , particularly by comparing rates and conditions.

Respect the formalities : any refusal or acceptance must be formalized to be enforceable.

The notary checks that the clause is correctly included in the compromise.

He advises the parties on deadlines and procedures.

Real estate agents must support the buyer in their process and relay important information.

They can also play a mediation role in the event of difficulties.

Obtaining administrative authorizations (e.g. building permits).

No right of pre-emption.

Obtaining additional certificates or diagnoses.

Lifting of any easements or charges.

The suspensive condition of obtaining a loan is an essential safeguard in a sales agreement. Its precise wording, strict adherence to deadlines, and transparency in the process are essential to secure the transaction, avoid disputes, and allow all parties to proceed calmly to the signing of the final deed.

Upon signing the compromise, the buyer must quickly:

Create a complete file including proof of identity, income (pay slips, tax notices), bank statements, proof of expenses and debts, and any document required by the bank.

Define your needs precisely : amount, duration, type of loan (amortizable, in fine, fixed or variable rate).

Contact several financial institutions to compare offers and negotiate conditions.

The bank studies the buyer's solvency (income, personal contribution, debt ratio).

She analyzes the property to be financed (value, location, condition).

The decision can be quick or take several weeks depending on the complexity of the case.

The buyer must be responsive in providing all additional documents requested.

If accepted , the bank submits a formal loan offer.

The buyer must respect a 10-day reflection period before accepting the offer.

The accepted offer triggers the lifting of the suspensive condition in the compromise.

In the event of refusal , the suspensive condition is not lifted, which allows the buyer to withdraw without penalty.

The buyer must demonstrate an active and sincere approach.

He must multiply the requests, not be satisfied with a single proposal.

He must keep all evidence (letters, emails, responses from banks).

In case of difficulty, he can contact a mortgage broker.

Building permits, prior declarations, or other authorizations may be required.

The compromise provides a deadline for obtaining these documents.

Failure to comply with this condition may void the sale.

Some communities have a right of pre-emption on sales.

The compromise is subject to a period of review by these communities.

If a right of pre-emption is exercised, the sale is cancelled.

Verification of the absence of easements preventing the use or resale of the property.

The compromise may include a suspensive condition linked to the lifting or regularization of these charges.

Clearly write each condition in the compromise, with specific deadlines.

Provide the methods of proving the steps taken.

Anticipate risks by multiplying sources of financing.

Involve the notary and professionals from the start to support the buyer.

Communicate regularly between buyer, seller, notary and real estate agents to avoid misunderstandings.

Limit yourself to a single loan application instead of multiplying the steps.

Failure to respect the deadlines imposed in the compromise.

Provide incomplete or disorganized banking information.

Not communicating clearly with the notary or real estate agent.

Failing to request a maximum rate or maximum duration in the suspensive condition, exposing the buyer to an overly expensive loan.

Neglecting other suspensive conditions (right of pre-emption, building permit).

Identify all conditions precedent.

Note the time limits for each condition.

Gather the necessary supporting documents and banking documents.

Provide sufficient personal contribution.

Apply to several banks or a broker.

Compare the offers received.

Respond quickly to additional requests.

Keep all communications and evidence.

Submit the accepted loan offer.

Lift the suspensive condition before the deadline.

Look for other financing solutions.

Use the suspensive condition clause to withdraw without cost.

Practical tool for real estate agencies and agents

Recover the full title deed

Provide the latest property tax notice

Obtain the cadastral plan and site plan

Check the presence and validity of property diagnostics (asbestos, lead, termites, DPE, gas, electricity, etc.)

Request a town planning certificate if necessary

Collect valid IDs from sellers

Collect valid IDs from buyers

If the seller is a legal entity, attach the up-to-date articles of association and K-bis

Check and attach the signed sales mandate (type of mandate: exclusive, simple, etc.)

Obtain the complete co-ownership regulations

Attach the minutes of the last general meetings

Provide the dated statement established by the trustee

Check the mortgage situation and provide proof of absence of mortgage

Attach any certificate of conformity

Clearly define the loan condition precedent (yes/no)

Indicate the amount of the loan envisaged

Specify the maximum loan duration accepted

Mention the agreed ceiling interest rate

Attach the formal commitment to seek financing signed by the buyer

Specify whether a sequestration is planned, its amount and its terms

Check the latest internal co-ownership regulations

Obtain the statement of charges for the last fiscal year

Confirm ownership of the common areas concerned

Attach the minutes of general meetings mentioning decisions impacting the sale

Specify and document all easements, rights of way or special features

Prepare a complete, organized file with clearly named files

Accompany the sending of an explanatory note on the context of the negotiation

Check completeness with the notary before final submission

Confirm that the file has been received by the notary and that it has started to be processed

Collaborate regularly with the notary or his colleagues when preparing the file

Anticipate the collection of documents by contacting the various administrations or services in advance

Ensure each part is up to date and legible to avoid delays

Maintain transparent communication between all parties (sellers, buyers, notary, agency)

Avoid neglecting any document even if it seems secondary

This rigorous control tool guarantees the creation of a solid file, allowing the notary to quickly draw up a secure compromise, limiting back and forth and blockages.

Discover the properties and beautiful residences for sale in France: castles, villas, exceptional apartments on the Propriétés De Charme portal.

Charming properties luxury real estate portal for sale of luxury houses , prestigious villas and character properties , in France and internationally . prestigious real estate lovers , looking for rare properties offering an exceptional living environment.

Whether you are looking for a luxury real estate purchase or a seller owner , or even a prestigious real estate agency , explore our advice and articles on the theme of luxury real estate, market trends, prestigious destinations and much more.

Discover the luxury market in Rouen: popular neighborhoods, types of properties, prices and advice for buying a villa,

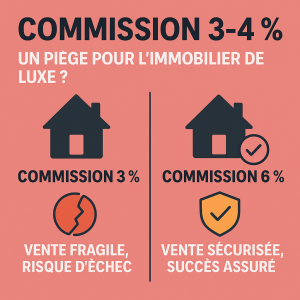

A 3% commission in real estate devalues the service. Choose an agency that offers tailored support to maximize value.

Discover the luxury real estate market in Guadeloupe and publish your ads on Propriétés de Charme, the dedicated portal

Discover the luxury real estate market in Cannes: prices, popular neighborhoods, 2025 trends and investment opportunities for individuals and

Compare ads

ComparePlease enter your username or email address. You will receive a link to create a new password via email.